Table of Contents

- Tax extension grunge rubber stamp on white background, vector ...

- File Extension Taxes 2025 Free Pdf - Sophia M. Gaertner

- Get an Extension for Filing Taxes: Steps to Postpone Your Deadline

- How to File a Tax Extension - Resources and Instructions

- How to File a Federal Tax Extension | Steps, Complications

- Extension For Taxes 2025 - Meryl Suellen

- How to file a tax extension in USA – TechStory

- How to File a Tax Extension — Stride Blog

- Tax Day: How to file an extension on your 2020 federal income tax ...

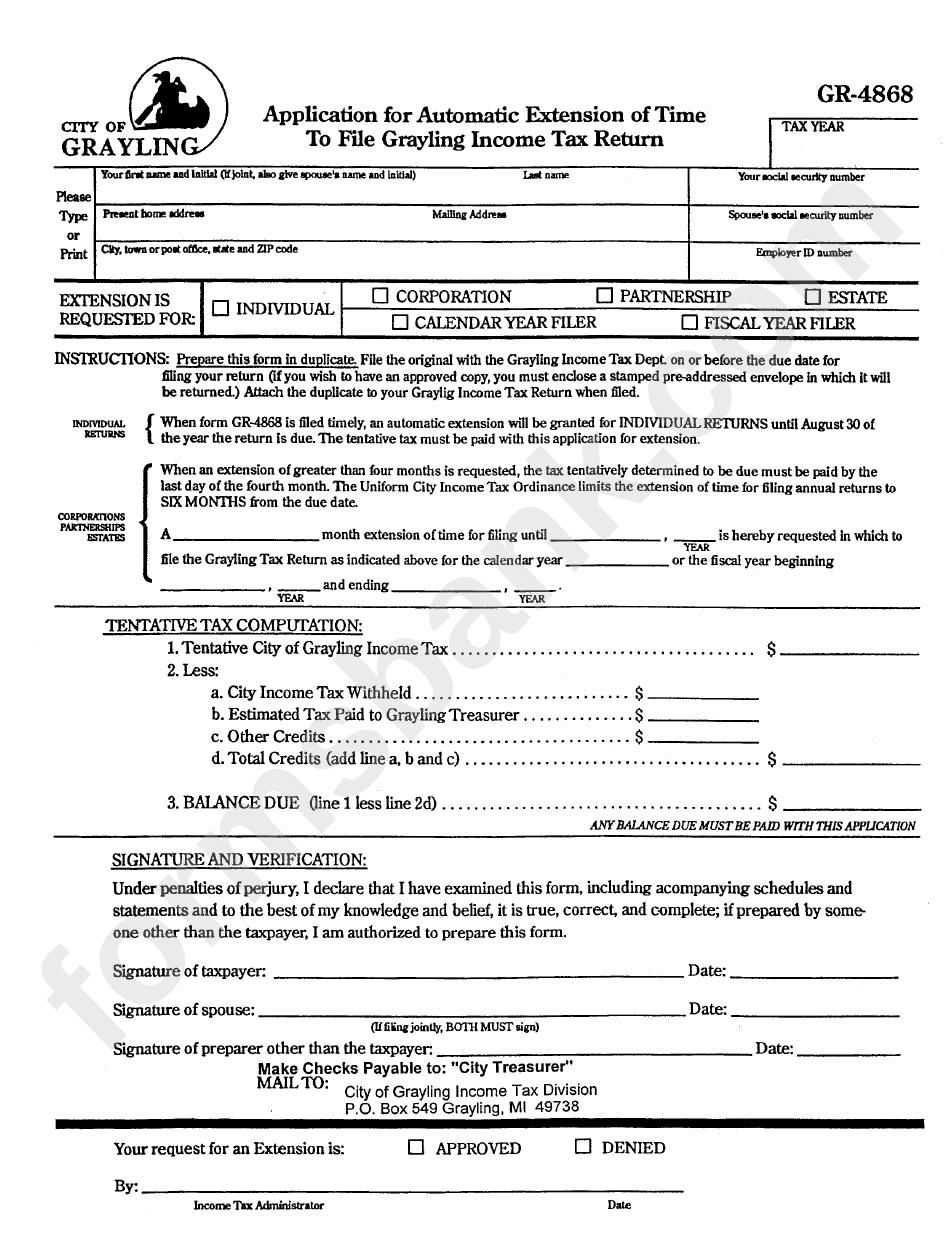

- Printable Tax Extension Form

Which States Are Affected?

What Is the New Tax Deadline?

The new tax deadline for individuals and businesses in the affected states is August 15, 2023. This means that taxpayers in these states have an additional four months to file their tax returns and make payments without incurring penalties or interest. The original deadline was April 15, 2023, but the IRS has extended it to provide relief to taxpayers who have been impacted by the natural disasters.

Who Is Eligible for the Tax Deadline Extension?

The tax deadline extension applies to all individuals and businesses in the affected states, including: Individuals who live or have a business in the affected states Businesses that have operations in the affected states Tax-exempt organizations that have operations in the affected states Taxpayers who are eligible for the extension do not need to take any action to receive the extra time. The IRS will automatically apply the extension to all eligible taxpayers.